- Flagged

- Posts

- 🚗 How UBER's "one-time" legal costs inflate EBITDA every year

🚗 How UBER's "one-time" legal costs inflate EBITDA every year

Hola 👋, this is Aquiba! Welcome to a new issue of Flagged, a newsletter exposing red flags at shady companies.

TLDR

What Happened?

Uber has reported strong Adjusted EBITDA growth in 2024, excluding hundreds of millions in "Legal, tax, and regulatory reserve changes and settlements" for the first nine months. The company's accrued legal reserves reached $1.4B as of Q3 2024.

Hidden Risk:

Despite classifying these as one-time costs, SEC filings reveal these legal settlements and regulatory penalties are a consistent annual expense, ranging in hundreds of millions of dollars.

Why It Matters:

The company's adjusted profitability metrics mask significant recurring legal costs. By excluding these expenses from EBITDA, investors may be overestimating true operational earnings power.

Context:

By building a $1.4B legal reserve, UBER acknowledges a material likelihood of having to pay significant settlements across multiple fronts:

Worker classification disputes

Fair Credit Reporting Act violations

Background check compliance issues

Privacy and data protection claims

Antitrust investigations

Employment discrimination claims

Here's a fun game: count how often Uber has reported "one-time" legal costs in the past few years. These supposedly exceptional expenses have become as predictable as New Year's Eve surge pricing.

By Q3 2024, Uber had tucked away $1.4 billion in legal reserves - enough to fund several startups but not enough to warrant inclusion in their adjusted earnings metrics. The company excludes these "Legal, tax, and regulatory reserve changes and settlements" from its Adjusted EBITDA calculations, treating them like unexpected guests at a party rather than permanent residents of their income statement.

But here's where it gets interesting: dig into Uber's SEC filings and you'll find these "exceptional" costs showing up with the reliability of a well-maintained Toyota Camry. We're talking hundreds of millions of dollars annually, spread across various legal troubles - worker classification disputes, privacy violations, antitrust investigations, and more.

Consider this: when a company faces similar legal challenges year after year, at what point do these costs become another cost of doing business?

The real kicker? These aren't just random legal spats. They're direct consequences of Uber's core business strategy. Worker classification disputes? That's the gig economy model. Privacy concerns? That's the data-driven approach. Antitrust investigations? That's the network effect at work. These aren't bugs - they're features.

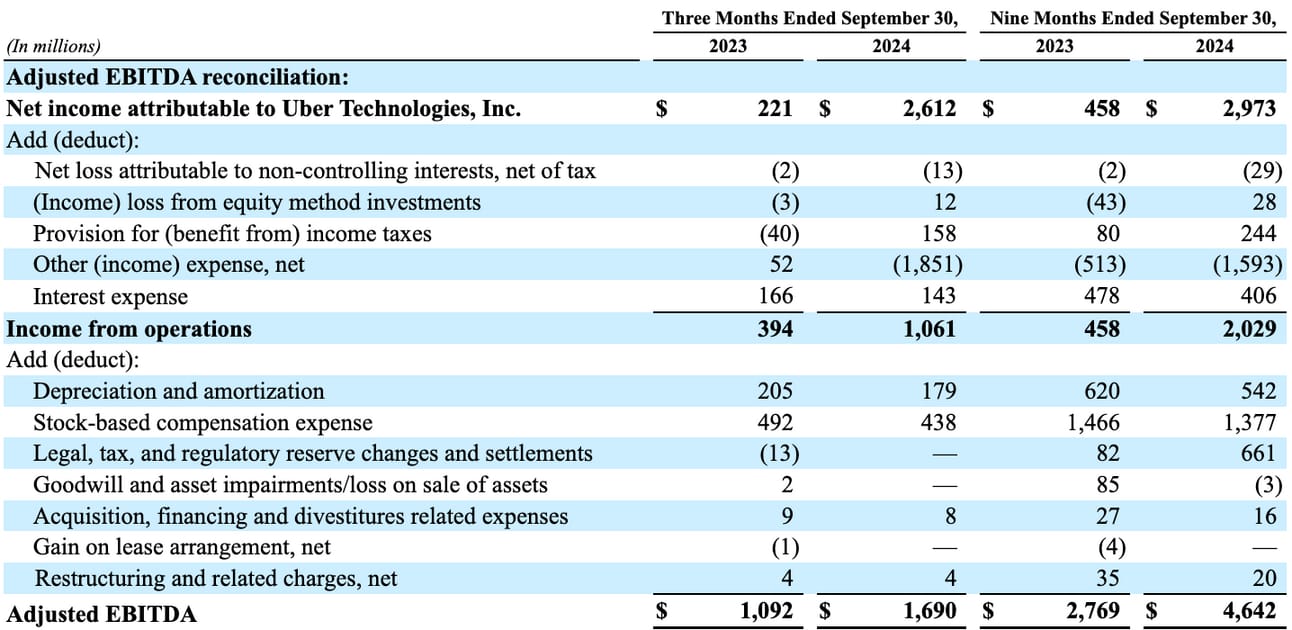

Let's look at the actual numbers. For the first nine months of 2024, Uber reported Adjusted EBITDA of $4.64 billion - a significant improvement from $2.77 billion in the same period of 2023. Even after adding back the $661 million in legal costs, the company's operational performance shows marked improvement.

But two major adjustments warrant investor attention:

Legal settlements and regulatory penalties: $661M

Stock-based compensation: $1.38B

Together, these items total over $2 billion - nearly half of reported Adjusted EBITDA. While excluding stock compensation is a common practice among tech companies, the recurring nature of legal costs raises questions about their "exceptional" status.

So next time you see Uber report 'exceptional' legal costs, remember: in this game, the exceptional has become routine. The company's core business is undoubtedly improving, but investors would be wise to count all the costs - not just the ones Uber wants them to see.

The information in this newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security.